child tax credit monthly payments continue in 2022

President Biden wants to continue the child tax credit payments in 2022. That includes the late payment of advance payments from July.

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

And although the monthly payments have expired eligible families can still claim the full Child Tax Credit on their income taxes when they file their 2022 taxes in 2023.

. 1 Child tax credit payments will continue to go out in 2022 This final batch of advance monthly payments for 2021 totaling about 16 billion was sent to more than 36million families across the country. And while the final monthly payment of 2021 went out Dec. Whether that includes monthly payments and how many parents will be eligible will be up to Congress.

Staff Report March 14 2022 517 PM. The American Rescue Plan allows families to opt in to receive the monthly payments. More payments will go out in the new year according to the Internal Revenue Service.

Manchin reportedly told the White House he would support the continuation of the monthly child tax. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. But the changes they may make.

The new expansion to the Child Tax Credit is temporary. This first batch of advance monthly payments worth roughly 15 billion. IR-2021-153 July 15 2021.

Millions of families were lifted out of poverty by. Families who received monthly payments in the second half of last year can still get up to 1800 for children younger than 6 and 1500 for children ages 6 to 17 as part of their refund. That effort took a significant turn on Sunday.

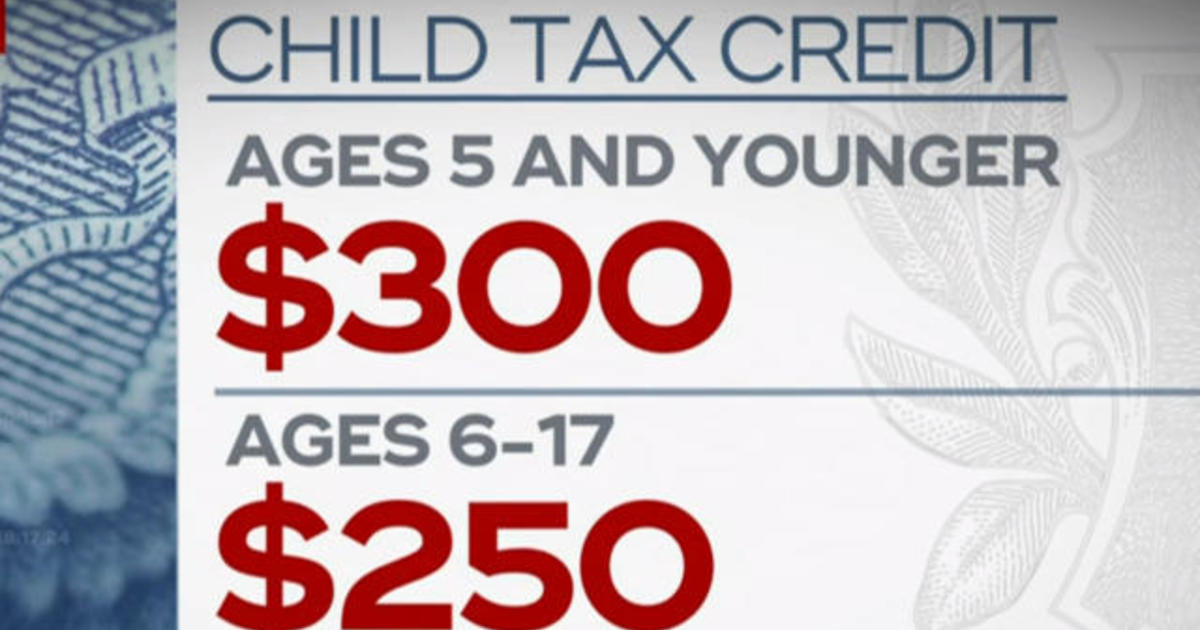

In 2021 President Biden expanded the child tax credit from 2000 to 3600 and let families collect monthly payments in advance. At the center of the American Rescue Plan is a monthly payment structured as a tax credit for the vast majority of families of 300 per child under 6 years old or 250 per child between ages 6. Prior to the expansion and boost to the Child Tax Credit in the spring of 2021 under the American Rescue Plan the last revision of the tax code in 2017 the Tax Cut and Jobs Act TCJA doubled.

Advanced monthly payments totaled. In total itd cover 35 million householdsor 90 of those with. As of right now the 2022 child tax credit which you would get when you file in 2023 is set to go back to 2000 for each dependent age 17 or younger.

15 there is still more of that money coming to Americans in 2022. And while the final monthly payment of 2021 went out Dec. If you have a newborn child in December or adopt a child you can claim up to 3600 for that child when you file your taxes in 2022.

The benefit is set to revert because. However Congress had to. The child tax credit will continue in some form.

If signed into law the White House says the bill would mean the 250 and 300 monthly payments would go out monthly in 2022. 15 there is still more of that money coming to Americans in 2022. In fact he wants to try to make those payments last for years to come all the way through 2025.

Most payments are being made by direct deposit. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families. The 2022 child tax credit is set to revert to 2000 for each dependent age 17 or younger.

Washington lawmakers may still revisit expanding the child tax credit. Half of the credit -. Families who utilized the six monthly advance payments can expect to receive 1800 for each child age 5 and younger and 1500 for each child between the ages of.

He had hoped to continue that in 2022 but without the passing of the Build Back Better bill the credit returned to 2000. FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double payments. THE child tax credit payments have helped millions of Americans financially in 2021 but some are wondering if they will continue beyond this year.

The plan raised the existing child tax credit from 2000 to up to 3600 per child for ages 5 and younger and 3000 for each child aged 6-17. The law authorizing last years monthly payments clearly states that no payments can be made after December 31 2021. For 2021 taxes families.

The enhanced CTC payments were originally included in the American Rescue Plan to help families through the pandemic as previously reported by GOBankingRates. The child tax credit will continue in some form. As it stands right now child tax credit payments wont be renewed this year.

However for 2022 the credit has reverted back to 2000 per child with no monthly payments. How Will the Child Tax Credit Impact Families in 2022.

Child Tax Credit Is Expanded Child Tax Credit Dead Did It Help Deseret News

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Monthly Payments To Begin Soon The New York Times

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Childctc The Child Tax Credit The White House

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Will Child Tax Credit Payments Be Extended In 2022 Money

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

Child Tax Credit When Will Monthly Payments Start Again Fingerlakes1 Com

What Families Need To Know About The Ctc In 2022 Clasp

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Federal Stimulus Update Will Child Tax Credit Monthly Payments Restart

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities