idaho state income tax capital gains

Your average tax rate is 1198 and your marginal tax. Mary must report 55000 of Idaho source income from the gain on the sale of the land.

How High Are Capital Gains Taxes In Your State Tax Foundation

Web While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income.

. Web To qualify for the Idaho capital gains deduction a taxpayer must report capital gain net income as defined in Section 12229 Internal Revenue Code on his. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on. Deduction of capital gains.

Web Additional State Capital Gains Tax Information for Idaho. If you make 70000 a year living in the region of Idaho USA you will be taxed 12366. Web Net 19 capital gains treated as ordinary income by the Internal Revenue Code do not 20 qualify for the deduction allowed in this section.

Web Taxes capital gains as income and the rate reaches 660. We last updated Idaho FORM CG in January 2022 from the Idaho State Tax Commission. This form is for income earned in tax year 2021 with tax.

This is the capital gain from federal Form 1040 line 7. Web While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income. Web The land in Idaho originally cost 550000.

Please refer to the individual tax return instructions for more information. The land in Utah cost 450000. Or shall own land actively devoted to.

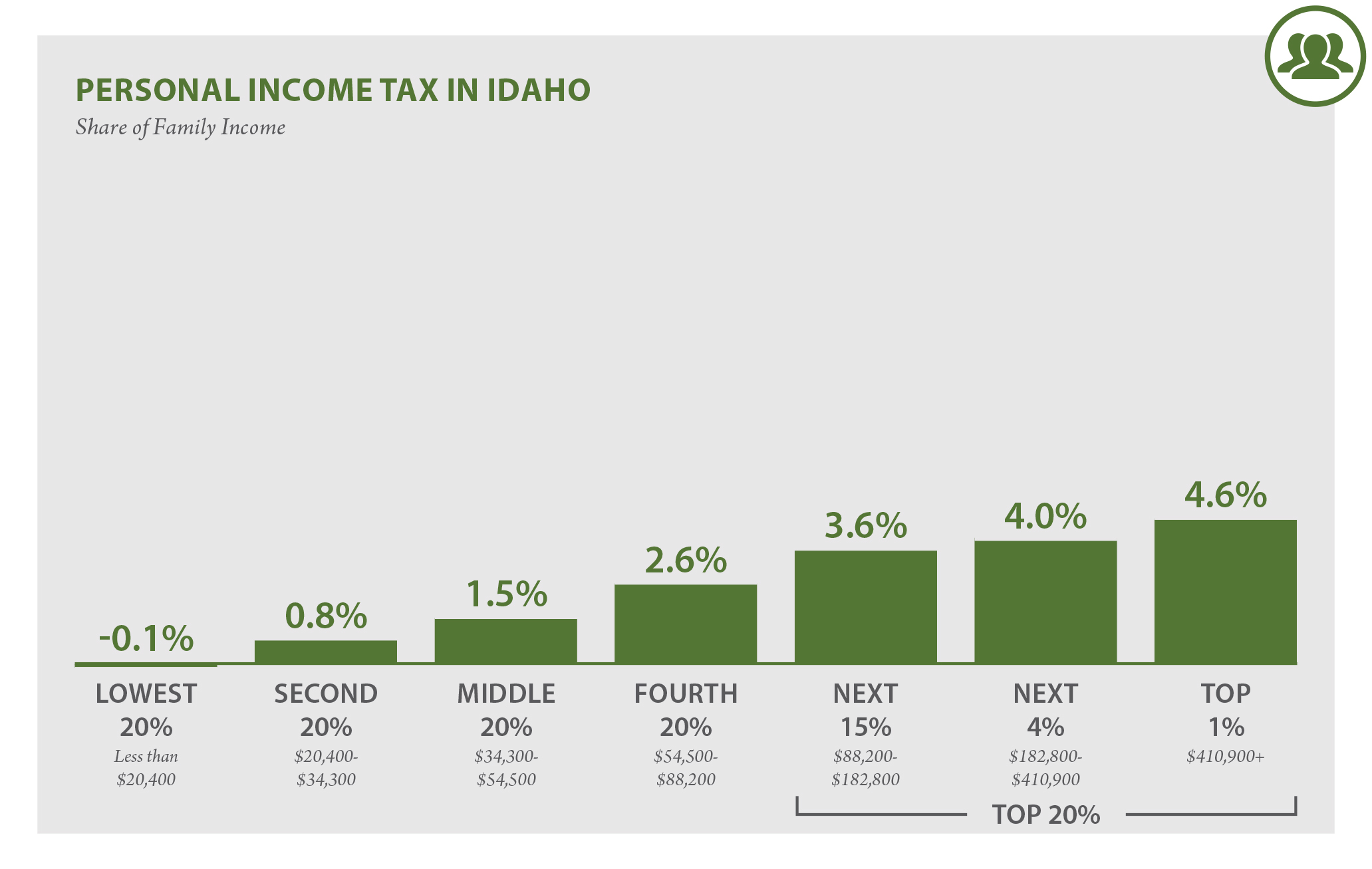

Web Enter your capital gain net income included in federal adjusted gross income. Web Idaho Income Tax Calculator 2021. For individual income tax the rates range from 1 to 6.

If you have a capital loss enter 0. Web While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income. Idaho has reduced its income tax rates.

Web More about the Idaho FORM CG. Web The owner claims the deduction on their Idaho individual income tax return. 1 If an individual taxpayer reports capital gain net income in determining Idaho taxable income eighty percent 80 in taxable year 2001.

Web Lower tax rates tax rebate. Idaho axes capital gains as. The corporate tax rate is now 6.

Taxes capital gains as income and the rate reaches 575.

Idaho 2022 Sales Tax Calculator Rate Lookup Tool Avalara

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Idaho Property Tax Calculator Smartasset

Idaho Income Tax Rates For 2022

1031 Exchange Idaho Capital Gains Tax Rate 2022

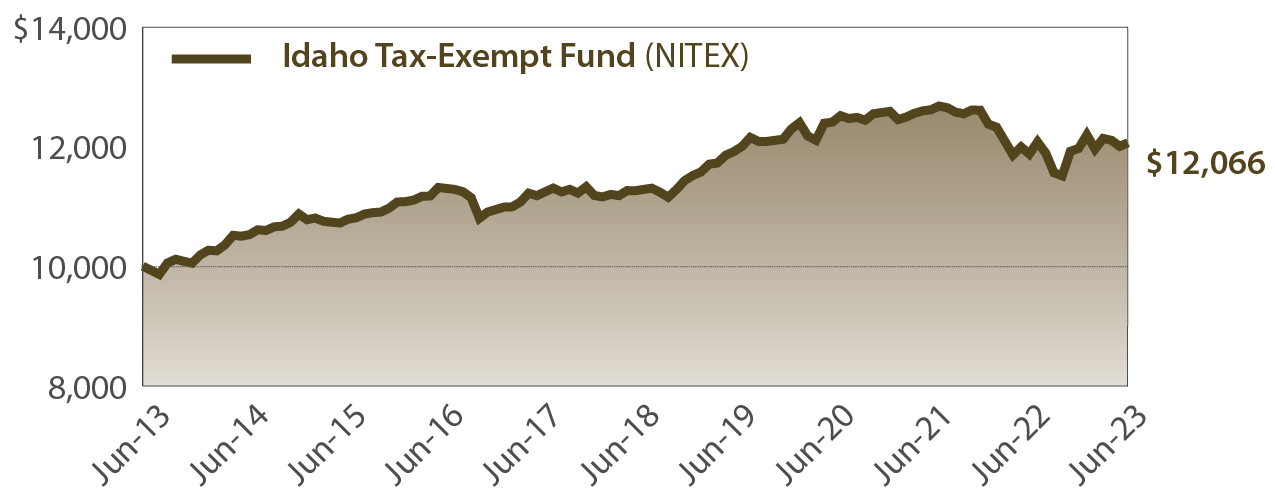

Idaho Tax Exempt Fund Saturna Capital

Idaho Senate Passes 600 Million Income Tax Bill Without Grocery Tax Repeal Amendment Idaho Capital Sun

Idaho Tax Exempt Fund Saturna Capital

Guide To Combined Reporting Idaho State Tax Commission

Gubernatorial Candidate Dave Reilly From Idaho Declares He Would Abolish Property Capital Gains And Income Tax For Idahoans Who Use Bitcoin R Bitcoin

Conformity And Child Tax Credits How Idaho S 100 Million Tax Cut Could Raise Taxes On Large Families Tax Policy Center

Historical Idaho Budget And Finance Information Ballotpedia

State Taxes On Capital Gains Center On Budget And Policy Priorities

Idaho State Tax Software Preparation And E File On Freetaxusa

Historical Idaho Tax Policy Information Ballotpedia

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Capital Gains Tax Idaho Can You Avoid It Selling A Home

22 Primary State Of The Idaho Democratic Party Coeur D Alene Press